Protecting your private information is our top priority.

Fraud Protection and Resolution

Protecting your private information is a top priority at Travis Credit Union and if fraud occurs we want to help. We provide all of our checking account holders with a free, comprehensive Identity Theft Assistance service that helps you during the fraud resolution process.

Highly trained identity theft caseworkers will guide you through the process of restoring your identity and credit records. Also, our Personalized Fraud Resolution Kit includes valuable educational information about fraud protection and resolution, government agency contact information, personalized letters to credit bureaus and instructions about filing police reports and fraud alerts.

Learn More

Fraud Monitoring

What is Falcon Fraud Monitoring?

Falcon Fraud Manager is a Neural Network. A Neural network is a computer system modeled of the human brain and nervous system. The system uses a Predictive Software Application that detects card fraud quickly and accurately, minimizing member risk and protecting member card information. They recognize complex hidden patterns of fraud, as well as emerging schemes, while minimizing unnecessary referrals and interference with legitimate transactions. A Predictive Software Application is a system that gathers information based on patterns and trends to provide a safe guard.

What happens if my Debit/Credit card is blocked?

If the Falcon Fraud Manager decides there is potential risk of fraud, an outbound call will be made to the cardholder. The call will be made via their automated 2way Connect System. Outbound calls are made from 8:00 a.m. to 9:00 p.m. in accordance with the time zone in which the cardholder lives.

If the account is queued after hours, the Virtual Analyst Warm Card block criteria will apply 24 hours a day and will always identify themselves as Travis Credit Union.

How will the Falcon Fraud Monitoring system contact me?

If a member's debit card or credit card has been blocked the Falcon Fraud Monitoring system will attempt to contact them a total of two times using the phone numbers on file. If the member is unable to be reached the member will receive a voicemail from Falcon, and the system will then attempt a second to contact the member but will not leave a second message. After the second attempt, the member will not receive another call unless there is another transaction queued for verification.

If a member makes a call back to Fraud Detection, the call will be answered by an IVR or Automated System. When a cardholder is calling back into the IVR to verify activity, they will be asked to validate the CVV/CVC2 as an additional authentication token. This additional token has performed well in identifying fraudulent attempts at validating transaction activity as it is often not included within visible point-of-sale compromise scenarios.

Through the automated system, cardholders identity will be validated using the billing zip code on the account. Cardholders will be asked to validate the last 3-5 transactions on the account as well as any other transactions the analyst deems as unusual.

Calls may be routed to a live analyst if:

- Member is reporting a Lost/Stolen card

- Member identifies possible fraudulent transactions

- Member chooses to speak to a live analyst for questions

- Member is unable to verify security or to enter valid information

If the member verifies fraud with a live analyst, the Falcon analyst will then transfer the member to TCU for the next steps.

Debit Cards

Members contacted by falcon will never be prompted to provide their PIN, or one time pass code. If you grow suspicious disconnect and contact us immediately at (707) 449-4000 or (800) 877-8328.

If activity is verified, the Warm Card block will be removed from the card and the member will need to wait between 5 and 10 minutes to use their card. At the end of that time the account will automatically move back into the normal processing strategy. If fraudulent activity is present, the account will be reported as Fraud and the card will be closed and the member will need to contact Travis for the next steps. If the member is unsure, a Warm Card block will remain on the account so the cardholder can research the transaction.

Credit Cards

If the member is contacted by Falcon to verify transactions, Falcon will contact the member via phone call, email, and text message.

The number Falcon will contact members is: (866) 518-0213

For Credit Card Dispute updates or information, please contact the Chargeback team:

(800) 268-1884, Option 4 or email Co-Op directly: Risk_Email@coop.org

Members may also be contacted via email. With the email option, Members will receive an email when fraud is suspected.

Email Opt-Out Procedures:

Cardholders cannot opt out of email alerts. If a cardholder no longer wishes to receive email alerts, the member will need to contact TCU for assistance.

Email Alert Sample

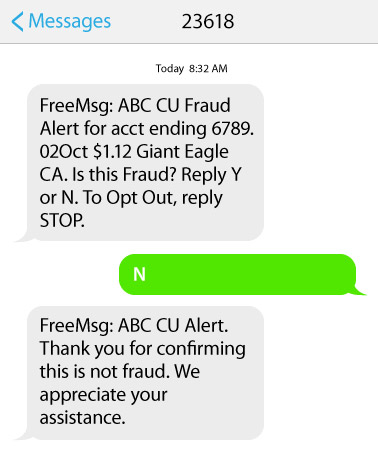

Cardholders may also be contacted text. With the text option, cardholders will receive a text message when fraud is suspected.

Text Opt-Out Procedures:

A cardholder can opt-out of text alerts at any time by replying “STOP” to a text message.

Text Alert Sample

If you have any additional questions about the Falcon Fraud Monitoring system, please feel free to contact our Member Service Center at (707) 449-4000 or (800) 877-8328.