Financial Health Checkup is an easy way to keep track of your overall financial health. This tool employs a combination credit rating using 7 indicators of your current financial situation.

How To Activate Financial Health Checkup

Note: If you have signed up for other Yodlee tools, then you will not see this screen and can skip to How To Set Up Financial Health Checkup.

- Go to your Account tabs.

- Scroll down to the Financial Health Checkup section and click Get Started.

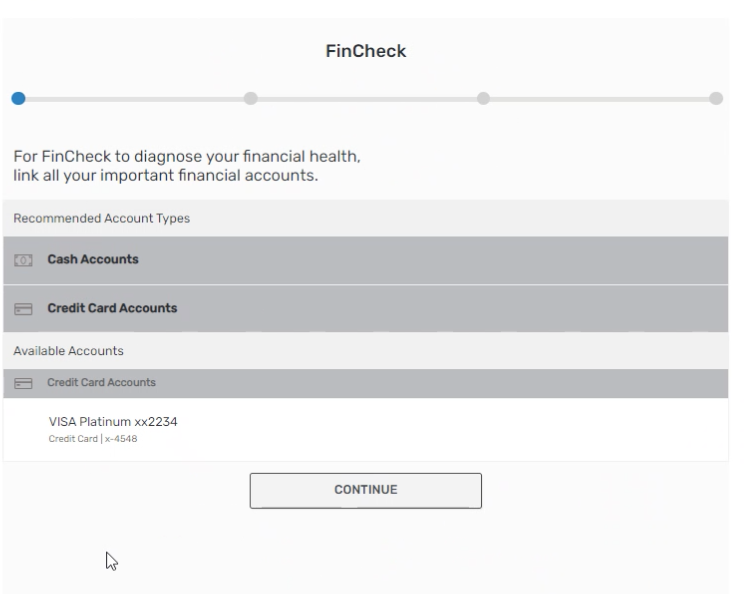

- Review your accounts.

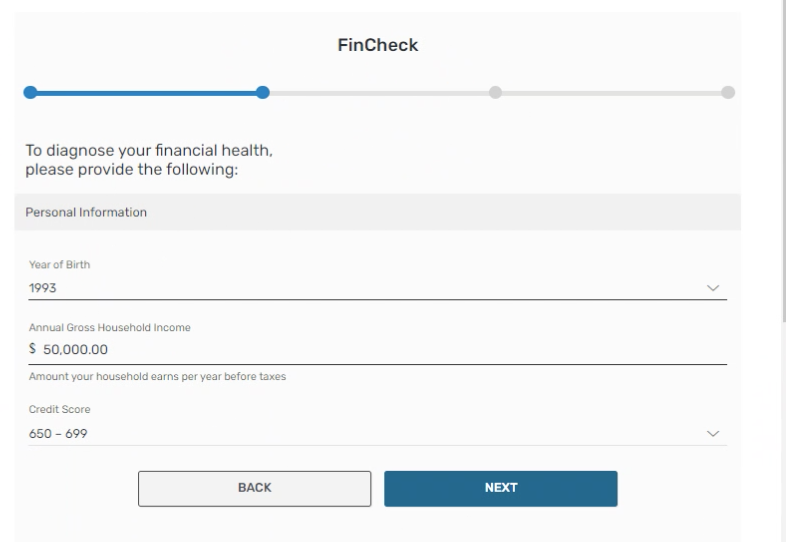

- Next you will need to answer some questions to help the tool generate information customized to you.

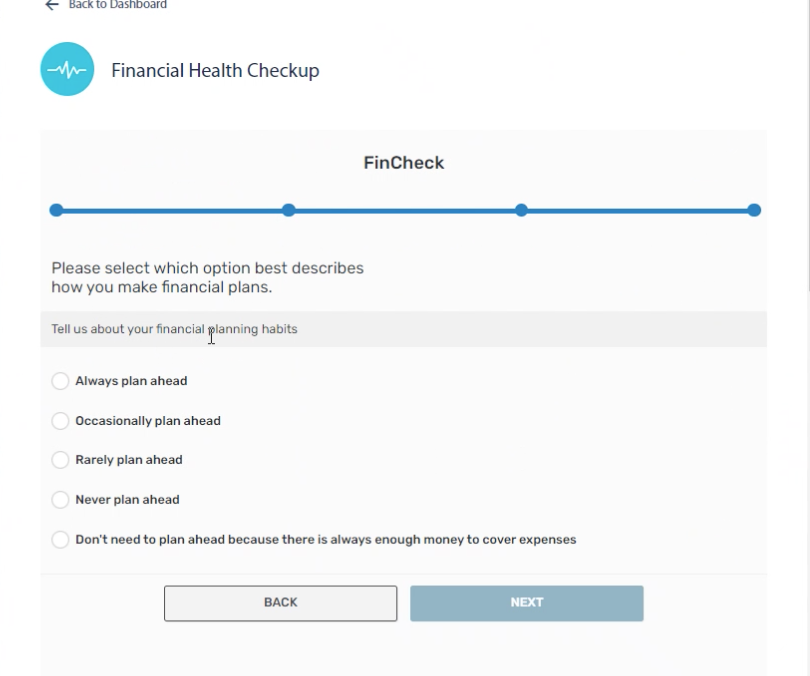

- Share your financial planning habits and goals.

- Click Ok, Let’s go.

How To Set Up Financial Health Checkup

In this step you will answer some questions to help the tool generate customized information.

- Link the accounts you wish to factor into your customized information. It is recommended to link your important financial accounts. Then click Continue.

- Input your personal information. Then click Next.

- Answer the questions about your financial planning habits by checking boxes. Then click Next.

- Click Ok, Let’s Go.

Result: Financial Health Checkup now has enough information to provide you with simulated financial situations.

How To Use Financial Health Checkup

Note: The information and ratings represented are based on your account details and other information you provided. The various outcomes presented are hypothetical and intended to provide general guidelines to improve your overall financial health. Your results and calculations may vary over time based on your behavior.

- Go to your Account tabs.

- Click View Checkup.

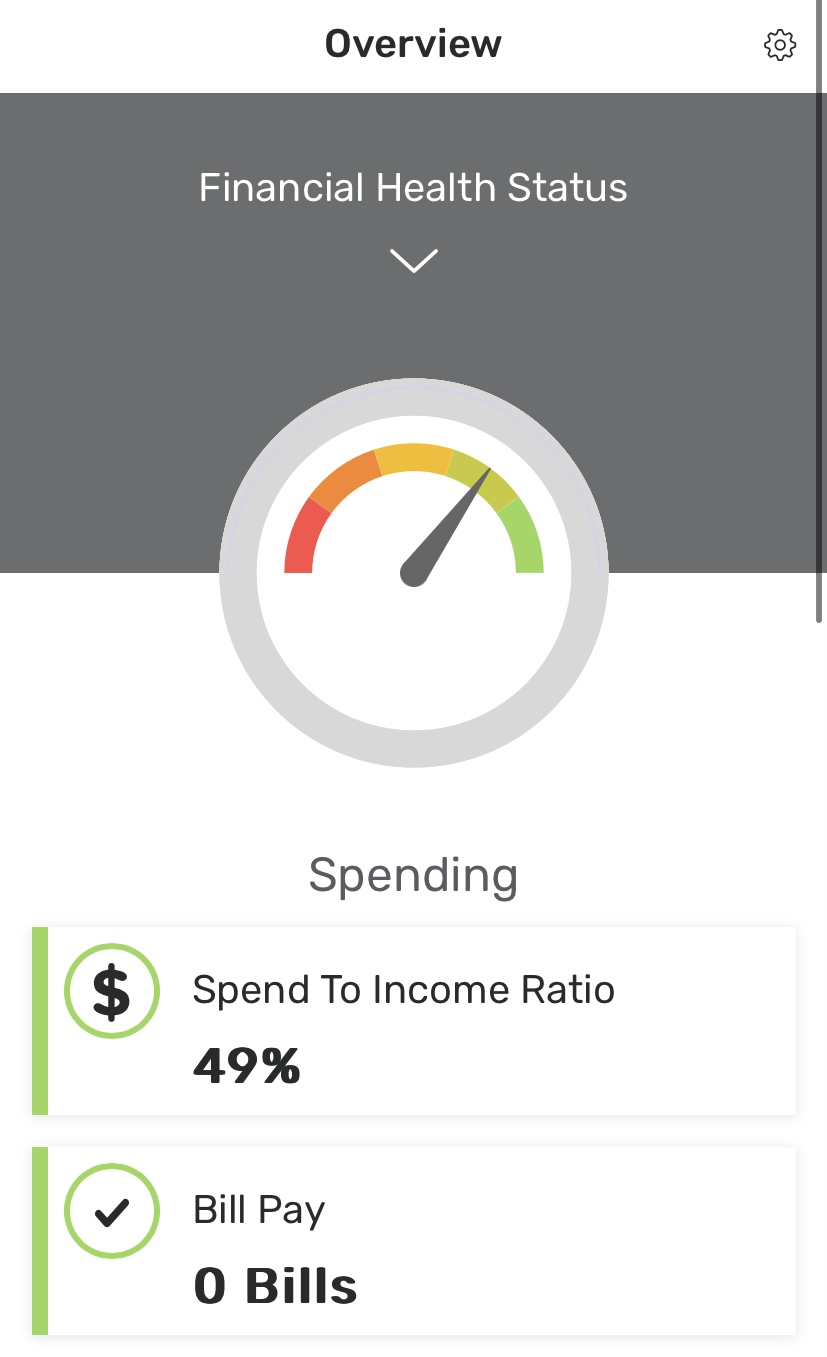

- You will be taken to an overview screen.

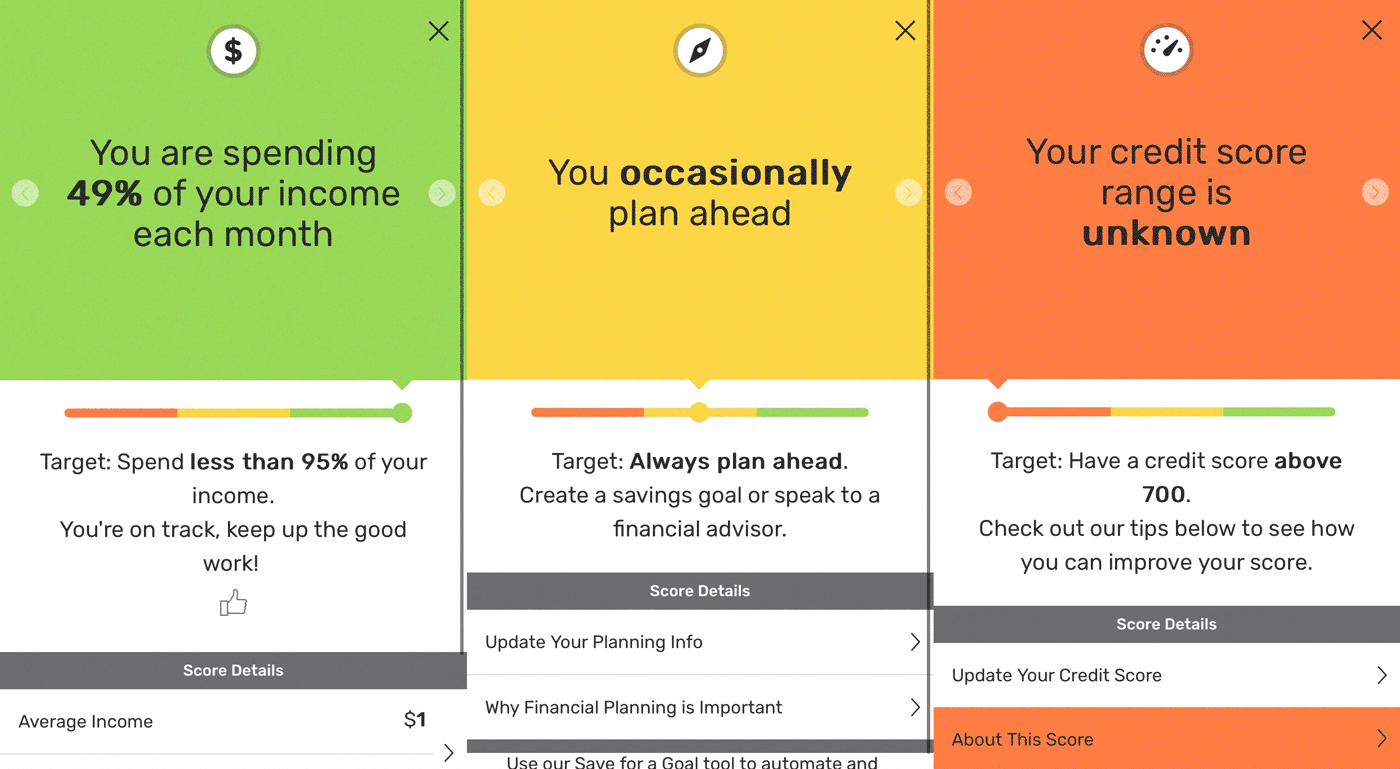

- You can tap into each category section to view your health stats individually. You can read more details about each rating, as well as update information about certain stats.

- Spending

Your Spend To Income Ratio is calculated by looking at your average spending over the last 3 months and comparing it to your average income for the same period. The accounts included can be checked/unchecked by tapping next to the boxes and tapping Save Changes.

Your Bill Payment habits are calculated from your recurring bill payments over the last 3 months from the accounts below. Then they are checked to see if any payments have been missed from the last full month.

- Borrowing

Your Debt To Income Ratio (DTI) looks at how much of your gross monthly income is spent on liabilities: auto loans, credit cards, mortgage payments, rent and credit lines. Living expenses such as cable, utilities, groceries, etc., are not part of your DTI.

Your Credit Rating is calculated based on a variety of factors including payment history, total amount you owe, age of accounts and usage, type of credit (mortgage, credit card, auto loan), and if you’ve taken on new credit.

- Planning

From the Insurance tab you can view your insurance plans, see suggested insurance plans, update your insurance info, and sign up for insurance.

Create a savings goal from the Planning Ahead tab.

- Saving

Your Emergency Savings score is based on how much disposable cash you have readily available from the accounts you have selected to cover at least 3 months of essential expenses. You can alter which accounts are included by checking/unchecking the boxes next to the accounts and tapping Save Changes.