So you’ve got your eye on buying a home in the next year or perhaps even sooner. One of the first things you should do when you start your home-buying journey is to check your credit score. Why? Mortgage lenders such as Travis Credit Union look at your credit score to determine the interest rates that will be available to you after you apply for a loan. The higher your credit score, the better your interest rate, which means you’ll pay less for your home purchase.

What is a Credit Score?

A credit score informs lenders how likely you are to pay back a loan and is based on your credit history, which is basically a trail of how you use money. Your credit history contains information about the number of credit cards and loans you have, how much you owe, your loan payment history and other details.

Three U.S. credit reporting companies – TransUnion, Equifax and Experian – collect this information to create credit reports for Americans. They also give your credit history a credit score number, usually between 300 and 850. The higher the score, the better your credit and the lower the risk you are to lenders.

The most widely used credit score is the one by the Fair Isaac Corporation. Its FICO® Score uses information from all three credit bureaus and other data. FICO® credit score ranges are:

| Credit Score |

Rating |

| 800+ |

Exceptional |

| 740-799 |

Very Good |

| 670-739 |

Good |

| 580-669 |

Fair |

| <580 |

Poor |

| |

Source: Myfico.com |

Travis Tip: You can check your credit report free each year

at annualcreditreport.com or calling

1-877-322-8228.

How Credit Reports Affect Mortgages

As mentioned earlier, mortgage lenders look at your credit score, your debt-to-income ratio and other things to assess the risk in lending you money. The highest scores represent the lowest risks to lenders, and in return, borrowers receive the lowest interest rates.

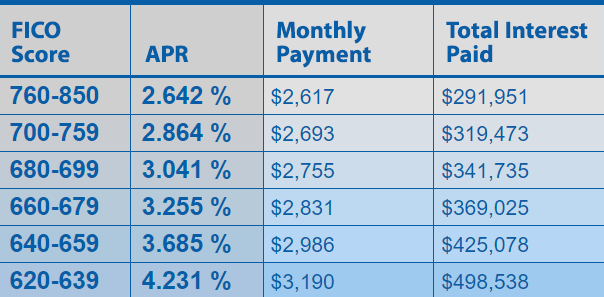

For example, this calculator graphic below from the myfico.com website shows the range of interest rates available based on FICO® scores for a 30-year, $650,000 home loan on Sept. 27, 2021.

Those with a fair FICO® score of 640-659 would pay a 3.685% interest rate, while someone with a very good-to-excellent score from 760-850 would receive a 2.642% interest rate. The difference in monthly payments is $369 or a significant $133,127 in total interest paid over the life of the loan.

This shows working to improve your credit before you buy a home can save you tens of thousands of dollars in the cost of your loan.

Source: Myfico.com calculator, 9/27/21

Improve Your Credit

With time on your side, there are ways to improve your credit score so that you’ll get the best rates possible when you’re ready to apply for a home loan.

First, take advantage of your free annual credit report (annualcreditreport.com) to see where you’re at. Take this opportunity to address any discrepancies on your reports directly with the credit bureaus because it could take months to correct.

Second, follow these steps to improve your credit score over time:

- Pay your bills on time (by the due date). On‑time payment history is key.

- Lower the amount of money you owe. High debt affects your score.

- Avoid getting new credit cards and lines of credit if you don’t need them.

- Keep older credit cards. Credit open for longer periods helps your score.

Another way to increase your credit score is through Travis Credit Union’s Experian Boost. You can raise your score instantly through this free program.

When You’re Ready to Buy – Apply at Travis!

We care about your dream to own a home and the steps you’re taking to become a homebuyer. Travis can help when you’re ready to apply for a mortgage. We’ll explain the home-buying process, review your unique financial situation and offer you genuine professional advice on the right home loan for your budget. Apply online today!